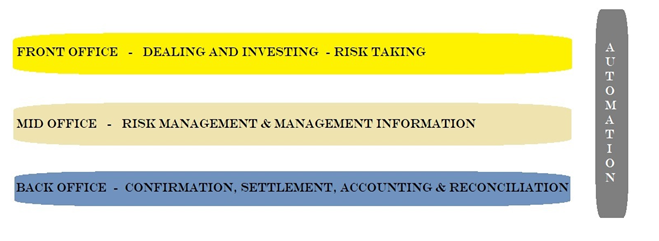

Basically, treasury has three different water-tight departments: Treasury Front Office, Treasury Mid Office and Treasury Back Office. There is a clear distinction in these three areas in terms of people and functions handled by each one of them.

The dealers would not get involved into settlements, confirmations, etc.. Md office would never strike a transaction (deal) or draft a confirmations. Back office would never get into valuations, risk management or deal making.

Different areas of overall Treasury Department:

1.2a Front Office:

The trading room is called the Front office. As the name suggests, the front office is client facing.

The front office of treasury has a responsibility to manage investment and market risks in accordance with instructions received from the bank’s ALCO (Asset Liability Management Committee). Deals are struck in the dealing room. Treasury also functions as a profit center of the Bank. It istherefore important that the treasury is managed efficiently. In view of this, control over theactivities of the treasury and its staff are critical to ensure that the bank is protected fromundue market risks.The dealers enter into transactions (either on behalf of customers or for proprietary deals) on the basis of current market price, which is ascertainedby them through the information network made available. Reuters and Bloomberg are amongst the companies which provide market information on a real time basis. In making deals,the dealers will have to adhere to the various limits such as counterparty exposure, daydealing limit etc. that have been prescribed and which is also a part of the risk management policy.

1.2b Mid Office:

As the name suggest, the middle office is literally in between the Front and the Back office. There may be few functions where there is an overlap and may fall in between mid and back office. The heads decide where they would lie and who would perform it.

Example; Accounting – Many banks would want the Mid office to make the accounting and adjusting entries. In many banks, the accounting piece is lying with the back office.

Mid-0ffce is responsible for risk measurement, monitoring and management reporting. The other main functions of mid office are:

- Limit setting – dealer-wise / currency-wise / portfolio-wise

- Monitoring exposures in relations to the above limits set.

- Forecasting likely market movements based on internal assessment and external / internal research.

- Hedging assets and liabilities

- Liquidity and funding

- Managing Market risk

- Monitoring open currency positions

- Calculating and reporting VaR (Value at Risk)

- Stress testing

- Risk-Return analysis